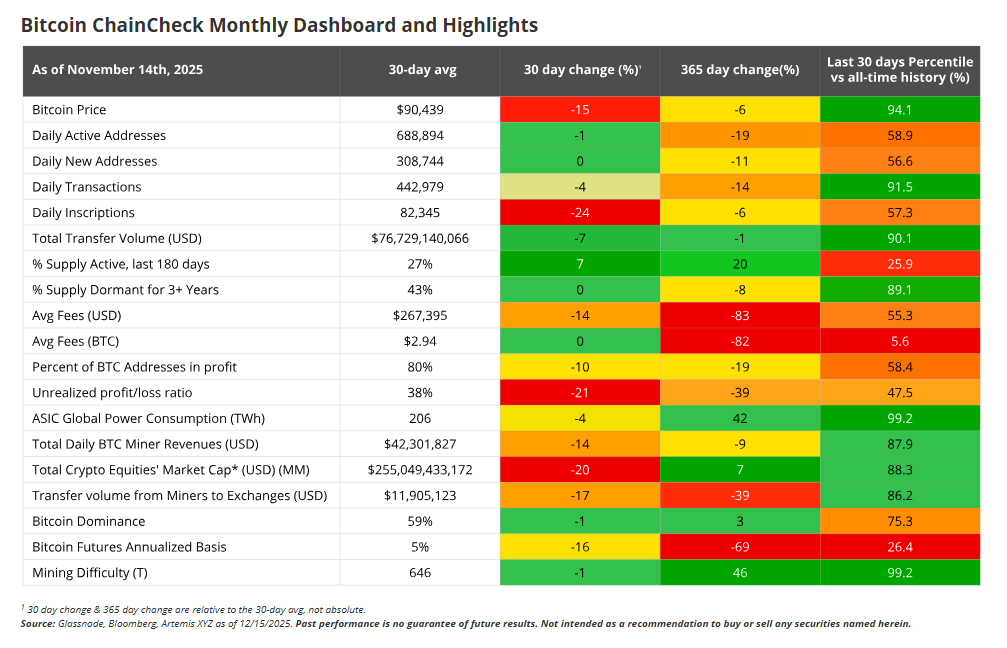

According to VanEck analysts, Bitcoin’s hashrate fell 4% over the month to Dec. 15. That move has caught the attention of market watchers because past instances of hashrate declines have often come before price gains.

VanEck’s Matt Sigel and Patrick Bush point to historical patterns: when hashrate fell over the prior 30 days, Bitcoin’s 90-day forward returns were positive 65% of the time, compared with 54% when hashrate rose. Numbers matter here, and traders are treating them as part of the evidence mix.

Hashrate Compression Can Signal Recoveries

Reports have disclosed that longer windows look better for bulls. When hashrate contracted and stayed low, the odds of a recovery improved over wider horizons. Negative 90-day hashrate growth was followed by positive 180-day Bitcoin returns 77% of the time, with an average gain of 72%.

Source: VanEck

The math is clear and the pattern is consistent enough to make investors take notice. Miner economics add to the story: the break-even electricity price on a 2022-era Bitmain S19 XP dropped nearly 36% from $0.12 per kilowatt-hour in Dec. 2024 to $0.077/kWh by mid-December. That shift squeezes margins and forces marginal operators to rethink their rigs.

Miners Exit, Markets Watch

Some capacity has left the network. VanEck tied the recent 4% decline to a shutdown of roughly 1.3 gigawatts of mining power in China. Analysts also warn that rising demand for AI compute could pull capacity away from Bitcoin, a trend they estimate might erase 10% of the network’s hashrate.

That would redistribute mining activity and could concentrate operations where power and policy align. At the same time, support for mining has not disappeared worldwide. Based on reports, up to 13 countries are backing mining activities, including Russia, Japan, France, El Salvador, Bhutan, Iran, UAE, Oman, Ethiopia, Argentina, and Kenya.

Price And Market Context

Bitcoin is trading near $88,600, down nearly 30% from its Oct. 6 all-time high of $126,080. Markets have been quiet around year-end and thin liquidity can hide real momentum.

Source: VanEck

BTC was monitored as steady near $89K in recent coverage and remained range-bound as traders weighed supply and demand signals. Other cross-asset moves matter too. Gold climbed above $4,400/oz while silver reached $69.44/oz, moves that some investors see as part of a broader safe-haven bid.

The data points suggest a cautious optimism. Miner capitulation has worked as a contrarian signal historically — weaker miners exit, difficulty adjusts, and surviving operators face less near-term selling pressure. That sequence can set the stage for price stabilization and gains over months.

Featured image from Pixabay, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.