In the face of a challenging macro backdrop, Roku (NASDAQ:ROKU) has performed well over the past year. It has frequently beaten analyst expectations, and its Q3 print featured more new users coming on board than had been expected, the successful implementation of cost cutting measures and a guide that called for positive EBITDA in Q4 and 2024.

With the streaming video platform about to deliver its Q4 results (Thursday, February 15, after the markets close), Wedbush analyst Alicia Reese thinks a solid report and outlook is about to drop. “Roku has committed to positive EBITDA in 2024, and we think it is on track to exceed expectations,” the analyst said. “We think that many of Roku’s initiatives will result in revenue growth higher than we modeled, and together with improved expense management, should drive consistent earnings growth.”

Looking at the bigger picture, as ad dollars transition from linear TV to digital connected TV (CTV), Roku keeps on taking market share. Additionally, as the ad market bounces back, the company is poised to “expand profitably” as a platform and free ad-supported TV (FAST) channel leader. Moreover, Reese believes Roku’s new advertising products, Roku Banner Ads on Roku City, and Roku Action Ads (an e-commerce partnership with Shopify) represent a “significant opportunity ahead.”

As for the raw numbers, Reese is calling for Q4 revenue of $965 million, adjusted EBITDA of $20 million and EPS of $(0.54). The Street has those numbers at $966 million, $16 million and $(0.55), respectively. Reece’s estimates factor in active accounts reaching 78.2 million, a 3.2% sequential increase and an 11.8% year-over-year improvement and TTM ARPU of $40.21, a 2% quarter-over-quarter drop and a 3.5% decline compared to the year ago period.

Ad trends are showing signs of improvement, with scatter pricing anticipated to hit an “inflection point” in the first quarter. Reese says Roku’s increasing prominence as a platform and its capacity to advertise across various CTV and TV channels offers it a significant advantage as advertising spend picks up. “In Q3,” notes the analyst, “Roku saw signs of a rebound in video advertising, even while linear and overall advertising spend significantly declined throughout the industry, and we expect this rebound to continue into 2024.”

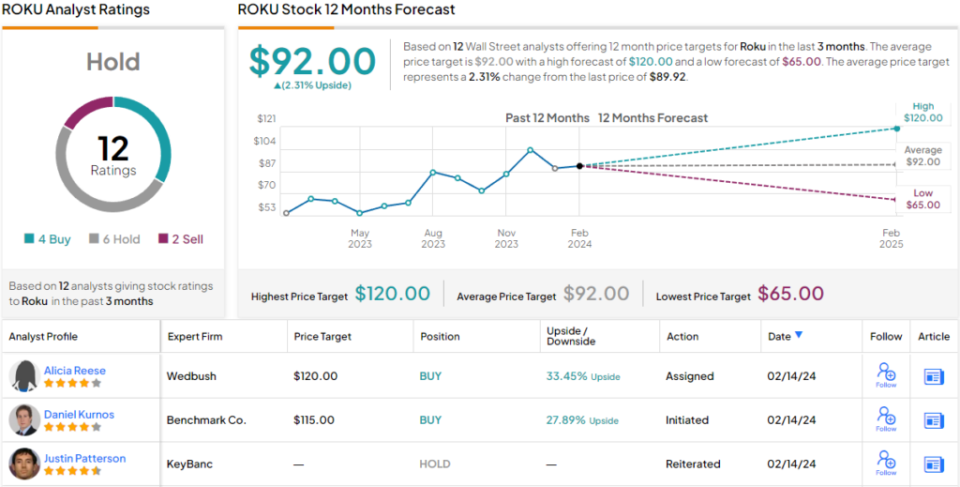

Conveying her confidence, Reese reiterated an Outperform (i.e., Buy) rating for the shares while her still Street-high price target of $120 represents 12-month growth of 22%. (To watch Reese’s track record, click here)

However, Reese is currently the Street’s biggest ROKU bull, and elsewhere, the stock receives an additional 3 Buys, 6 Holds and 2 Sells, all culminating in a Hold consensus rating. With the average price target currently stands at $92, the analysts anticipate shares to stay range-bound for the foreseeable future. (See Roku stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.