In this piece, I evaluated two Chinese Big Tech stocks, Baidu (NASDAQ:BIDU), and Alibaba (NYSE:BABA), using TipRanks’ comparison tool to see which is better. A closer look suggests neutral views for both, although a clear winner emerges — in the event that the overhangs dissipate.

China-based Baidu is one of the largest AI and Internet companies in the world. On the other hand, China’s Alibaba specializes in e-commerce, retail, and Internet-based technologies. Although the two companies don’t compete directly, both are Big Tech companies based in China, with Baidu often described as “China’s Google” and Alibaba tagged as “China’s Amazon.”

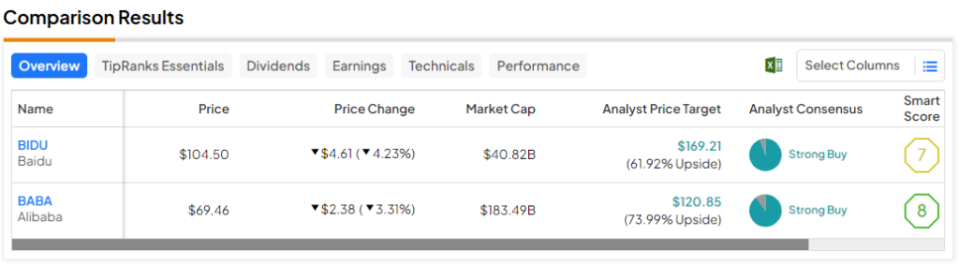

Shares of Baidu are off 20% over the last year after a 13% drop over the last three months. In fact, Baidu stock plummeted 7% on Friday alone, its largest decline in more than a year (more on that below). Meanwhile, Alibaba stock has plunged 39% over the last year, including a 16% decline over the last three months.

Although the two companies’ one-year drops are dramatically different, their similar recent declines stem from concerns about China.

In recent months, U.S.-listed Chinese stocks, in general, have been falling due to worsening relations with China, as evidenced by the Invesco Golden Dragon China ETF (NASDAQ:PGJ). The ETF tracks the Nasdaq Golden Dragon Index of Chinese stocks listed in the U.S. and is down 23% over the last year and off 8% over the last three months.

Additionally, Goldman Sachs (NYSE:GS) said in early December that China and the broader emerging-Asia market were among the most-net-sold regions by hedge funds in November. In fact, Chinese equities recorded their fourth consecutive month of net outflows from long/short equity managers and the ninth month of net outflows overall in 2023.

As such, the many China-specific issues do play a critical role in the ratings for both companies, although a closer look at the company-specific factors suggests a clear winner.

Baidu (NASDAQ:BIDU)

At a price-to-earnings (P/E) ratio of 12.6, Baidu is trading at a steep discount to its mean P/E of 24.6 since March 2019. Unfortunately, though, a recent report linking its Ernie AI platform to Chinese military research could continue to weigh on Baidu’s stock for some time, so a neutral view seems appropriate for now.

Baidu claims that its Ernie AI bot shares similar capabilities with OpenAI’s ChatGPT, the first generative AI bot capable of generating almost human-like responses to queries. Unfortunately, the South China Morning Post reported that a university affiliated with the arm of the Chinese military that handles cyberwarfare had tested its AI system using Baidu’s Ernie.

On Monday, the Chinese search giant denied any partnership or affiliation with that university and claimed no knowledge of the research in question. However, that report raised concerns about the possibility of U.S. sanctions against Chinese firms aimed at curbing such partnerships with the Chinese military.

Even without any sanctions, the report from the South China Morning Post could ratchet up tensions between the U.S. and China even further — at a time when those tensions are already running hot.

The paper from researchers with the Strategic Support Force of the People’s Liberation Army reportedly outlined theoretical situations surrounding the use of AI in conflicts between various nations, including the U.S. and Libya. The researchers also reportedly put hypothetical questions to Ernie and explained how the AI bot could be utilized to decide the best placement of military forces.

While it’s too early to say whether Washington will retaliate against Baidu or to gauge the long-term impact of the report, Baidu’s long-term stock-price returns also suggest limited upside in the near term. BIDU stock has plummeted 56% over the last three years, remaining in the red over the last five and 10 years, off 36% and 37%, respectively.

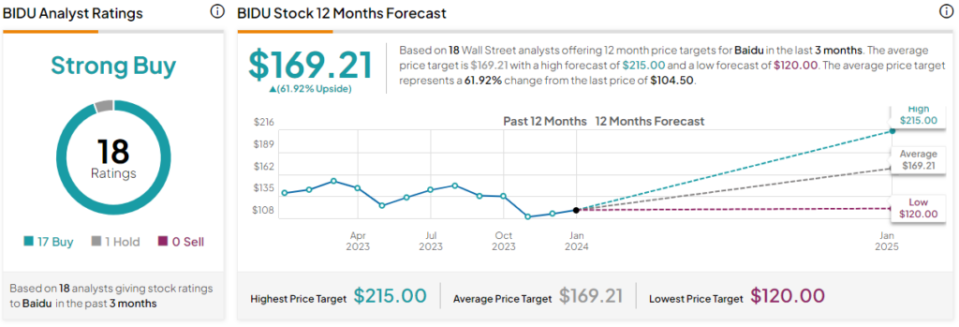

What is the Price Target for BIDU Stock?

Baidu has a Strong Buy consensus rating based on 17 Buys, one Hold, and zero Sell ratings assigned over the last three months. At $169.21, the average Baidu stock price target implies upside potential of 61.9%.

Alibaba (NYSE:BABA)

At a P/E of 10, Alibaba is trading at a steep discount to its five-year mean P/E of 35.2. However, the China-related issues have weighed heavily on its stock over the long term, suggesting a neutral view may be appropriate — pending some light at the end of the tunnel.

Previously, the most interesting part of the bull case for Alibaba shares was its plan to spin off six of its business units into separate companies, which could unlock significant shareholder value. However, it’s looking like most of those plans won’t happen.

Alibaba stock plummeted in November after the company announced it was scrapping its plan to spin off its cloud business due to the expanded U.S. restrictions on exports of computer chips. Previously, the company also halted its plans to list its Freshippo grocery retain chain, although it is moving forward with the listing for its Cainiao smart logistics business in Hong Kong.

While significant value could be unlocked for shareholders through these spinoffs, the cancellation of two of the six, including the most crucial cloud business, is cause for concern. Additionally, looking over the long term, Alibaba stock has plunged 71% over the last three years, remaining down 53% over the last five years and off 19% since September 2014.

Thus, until China’s economy begins to show real signs of recovery and some of the other China-related issues are resolved, or until more clarity around the planned spinoffs appears, a wait-and-see approach seems best.

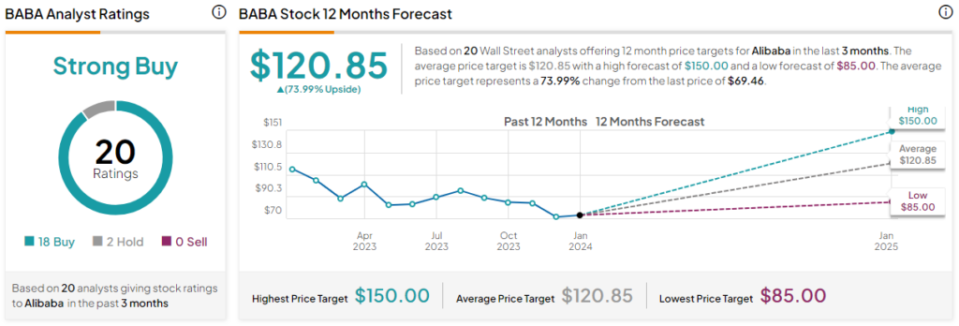

What is the Price Target for BABA Stock?

Alibaba has a Strong Buy consensus rating based on 18 Buys, two Holds, and zero Sell ratings assigned over the last three months. At $120.85, the average Alibaba stock price target implies upside potential of 74%.

Conclusion: Neutral on BIDU and BABA

Although both Baidu and Alibaba receive neutral views due to the potential issues in China, Alibaba is the clear winner, at least temporarily. Essentially, Baidu’s concerns involving the Chinese military look more imminent. Meanwhile, Alibaba could still unlock significant value for shareholders through multiple spinoffs — even though two of the six are definitely off.

However, the balance between these two Chinese stocks could suddenly shift, making Baidu the favorite if its issues are resolved or if Alibaba definitely cancels all the remaining spinoffs.