Do you have a wallet full of rewards credit cards? If so, you may have trouble remembering which one is best for your purchase when you step to the register.

That’s where CardPointers comes in. This credit card rewards app is designed to help you tailor your credit card use to maximize rewards. Following its advice can put more cash back in your pocket in the long run.

But can you accomplish your goals with the free version, or do you need to pay for the upgraded app to make it worth it?

For this review, I downloaded the CardPointers app on an Apple device to get the “free” experience firsthand. In this article, I’ll tell you everything you need to know about the app to help you decide whether you should download it and whether you should pay for it.

Table of Contents

What Is CardPointers and How Does It Work?

CardPointers is an app, website and browser extension designed to help consumers maximize the rewards, discounts and offers their credit cards provide.

In short, the concept is this: You’ll be asked to tell the app details about the credit cards in your wallet (not the actual card numbers!), and it will use that information to mine its credit card database to curate suggestions to optimize your rewards.

It has the capability of doing this in a variety of ways, including:

- Identifying the best rewards card to use for each purchase

- Tracking rewards value for spending with each credit card

- Spotting offers from your credit card company that could increase rewards

CardPointers claims on its website that “most” users save more than $750 per year by using the app.

There are both free and paid tiers of this app. For the purposes of this article, I used the free tools available and tried some of the free samples of the tools that are normally reserved for the paid tier of service.

Continue reading to see how I set things up with my account and to learn what I found once I settled into the app’s ecosystem.

Setting Up CardPointers

To get started with CardPointers, you’ll want to download the app to your device of choice. The CardPointers app is available in both the Apple App Store for iOS devices and the Google Play Store for Android devices.

As of September 2022, the app had a rating of 4.2 on Apple and 4.5 on Android with more than 10,000 downloads of each.

I downloaded CardPointers on my iPad to use as my primary testing device, but it’s also available on wireless phones, smartwatches and as a browser extension for both Apple Safari and Google Chrome.

Look for this logo to know you’re downloading the right thing:

No Personal Credit Card Information Required

When I heard about this app and considered giving it a try, my top concern was the privacy of my credit card information. But once I downloaded the app, I was pleasantly surprised to find that I didn’t have to give over any personal information.

You just have to provide an email address to set up an account, but you won’t be prompted to insert credit card numbers or your home address.

Instead, you’ll be asked to generically identify the credit cards you’re using, and CardPointers will use information about those cards from its database to give you advice.

CardPointers says it has a database of more than 5,000 credit cards from more than 900 different banks. That means most of the popular credit cards in the United States are covered here.

To get things started, I simply added information on the rewards credit cards I have in my wallet by using the app’s card search function.

5 Things To Know About Using CardPointers

Now that we’ve downloaded the app and selected the credit cards we want it to try, it’s time to look at all the ways we could use CardPointers to deliver on its promise to help us maximize rewards.

After spending a few days on the app with my card information loaded, I’ve identified five things you’ll want to know before you try this out for yourself.

1. Using the Right Card for Purchases Is the Primary Focus

Have you ever stood in the checkout line and had your mind start racing about which credit card is offering the best rewards for the purchase you’re about to make?

If you’re going to save more than $750 per year using this app as the creators claim, you’re going to have to use this function of the app consistently.

And there are a few easy ways that you can do this.

The app has a “Pointers” tab that helps you understand how your cards stack up in each spending category.

It also has a “Best Card Wizard” that will let you select the spending scenario and it will point you in the direction of the card that has the most valuable rewards offer going at that time.

I think this will be particularly useful for people who have credit cards with rotating rewards categories such as the Chase Freedom Flex or the Discover it Cash Back. It’s hard to remember those categories on the fly!

The Best Card Wizard limits the number of times you can use it if you’ve got the free version of the app, but Pro subscribers get unlimited access.

2. Tracking Offers From Your Credit Card Is Another Way To Save

Rewards categories for spending are not the only way you can save money by picking the right credit card. Many card issuers now have programs that incentivize using their cards for purchases by offering additional rewards or cash back with businesses.

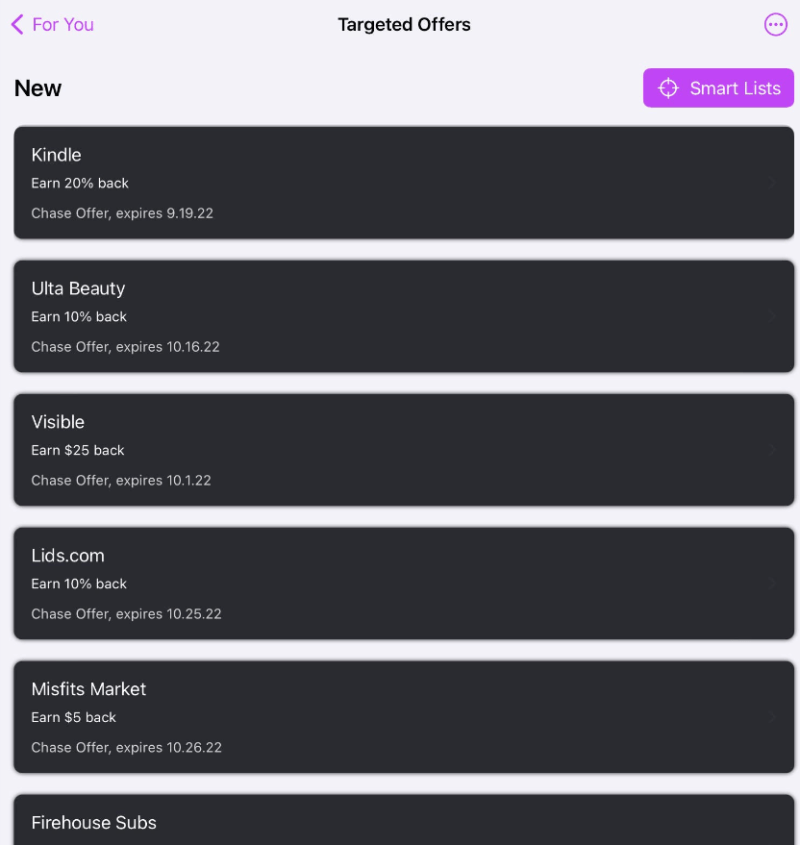

The Amex Offers and Chase Offers programs are two prominent examples of this strategy. This app tracks both.

This is a great way to save money, but people who have several credit cards often have a hard time keeping track of which card is offering which deal, when it expires, how much they have to spend to qualify and which business accepts it.

CardPointers has an entire library of these offers, which is updated in real time. This makes it a great resource for aggregating your offers and keeping track of them in one searchable spot. This helps you avoid moving from one card issuer’s website to another to find the best offer.

3. You Can Track Your Status on Welcome Bonuses or Category Rewards

If you have a new card with a sign-up bonus or a card that is rewarding a bonus for spending in a certain category for a limited time, the app will help you track those dates and your progress in hitting those spending limits.

Since you’re not entering any credit card information with the free version of this app, this may require some manual entries on your part.

4. You Can Get Enhanced Rewards Help via Browser Extensions and Geotracking

If the methods I highlighted above don’t automate the process enough to provide some low-effort rewards opportunities, perhaps the Pro version of CardPointers will get your attention.

If you’re willing to pay for the upgrade, you can activate tools like geotracking on the app and automatic alerts via browser extension that will prompt you more aggressively in real time to use the right card for optimal rewards.

For example, the geotracking could alert you to which credit card will give you the best rewards for a purchase made in Target by identifying that you’re in the location of that store. Or if you’re on Target.com, the browser extension could serve the same purpose before you move to the checkout page.

Keep in mind that these practices are a bit more intrusive and give the app more access to your personal information, general whereabouts and purchasing habits.

5. Tweaking Card Details May Be Necessary for Accurate Rewards Measurements

While I found the information in the CardPointers database on rewards programs to be quite accurate, there still may be some tweaking required to get the very best suggestions from the app.

Why?

CardPointers has a default monetary valuation for points earned by certain cards, and that may or may not fit the way you’re actually planning to use them.

For example, certain Chase cards incentivize using your rewards points for book travel through its Ultimate Rewards travel program by increasing the redemption value for using that method. So if you know you’re going to be using your rewards from a purchase toward Chase travel redemption, the value of those points to you may be different than the default setting shown for that card in the app’s database.

I ran into a valuation issue during my test of the Fidelity Rewards Visa on the app. The cash back redemption value of the card’s points is 1%, but you get unlimited 2% if you’re redeeming your rewards in a Fidelity investment account. Since I automatically dump my rewards into a Roth IRA, I consider that card to be an unlimited 2% card. But the app sees it as a 1% redemption card for most categories.

The good news: The app allows you to override the rewards valuation to tweak its recommendations.

Free vs. Pro: Which Is Right for You?

As I’ve mentioned a few times already in this review, CardPointers has a free tier available to anyone who downloads the app. But if you want to experience the full power of the app, you’ll need to pay to upgrade to a “Pro” membership.

Using the free version of the app will let you add your credit cards, find the best card to use for category-specific purchases and see a menu of all your credit card offers that could enhance your rewards earnings for a certain purchase.

Paying for the Pro subscription will unlock access to tools such as location-based reminders for in-store card use, notifications for offers from your credit cards and automated recommendations in the form of a browser extension that ensure you’re using the right card for online purchases.

The Pro subscription costs $40 per year. I also was offered a monthly rate ($5) and a lifetime subscription rate ($120).

There’s a seven-day free trial available, but be aware that it requires you to input credit card information and will trigger an automatic renewal at the end of the trial period.

Here’s a quick rundown of some of the tools and perks you get by paying for the upgrade as per the CardPointers website:

- Location reminders

- Direct integration into Apple Wallet through auto-updating passes

- Annual fee reminders

- Track 5/24 status with Chase

- Automatic reminder when you’re on a website where one of your cards has a bonus

- Track offer usage to the dollar

- Alerts when new offers are available that match your criteria

- Reminders before offers expire

- Ability to “snooze” offers that don’t interest you

- Automatic reminder when you’re on a website where you have an active offer

- Fully customize dashboard

Final Thoughts

Earning credit card rewards is great, but keeping track of the rewards programs, the oft-changing promotions and the like may be more than the average consumer wants to do.

It’s for this reason that money expert Clark Howard often recommends the simplicity of a cash back credit card with fixed rewards, such as the Citi Double Cash, as a way to “set it and forget it” with your credit card rewards.

But he also says using an app to help manage your credit card rewards is a totally acceptable way to reach for more rewards if you’re up for it.

“If you love gamifying how you buy things to get the biggest gain for every dollar that you spend, using an app that helps you do that is fine and great,” Clark says.

After a few days with CardPointers in my life, I can see the usefulness for many credit card users.

With just an email address to sign up and an app download on your phone, you can be on your way to being more aware of which rewards credit card to use in each situation. It’s not a totally automated process, but it’s a shortcut for sure.

And if you’re a high-volume spender with a large collection of personal or business credit cards, I could see giving the Pro subscription a try for a year to see if it can help you earn more rewards than the $40 subscription will cost you.